Tax Master

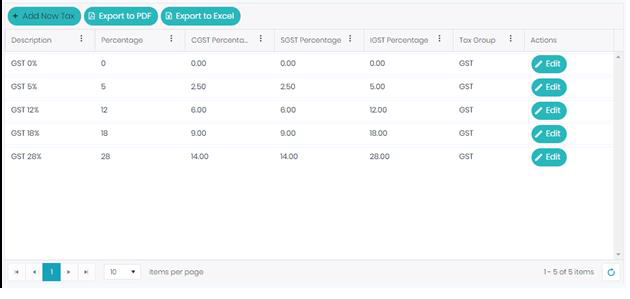

To create a new tax or want to edit existing details of tax, go to Masters, select Tax Master. Here we are having two tax groups, VAT and GST.

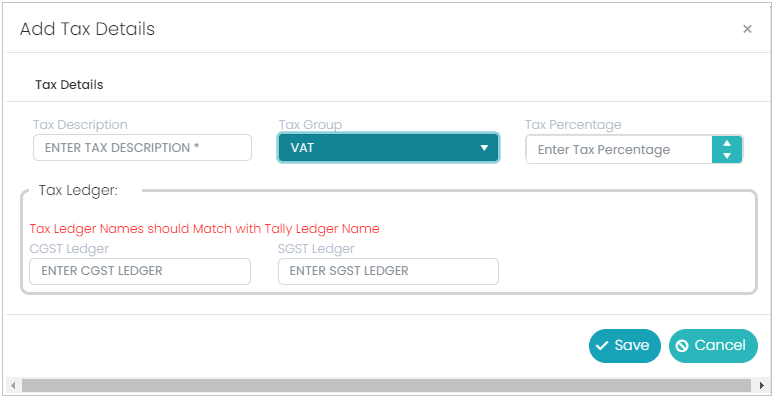

If we need to create tax percentage, which is related VAT, first click on Add new record button to create new Tax, select VAT from Tax Group field, fill the remaining details and click on Save button.

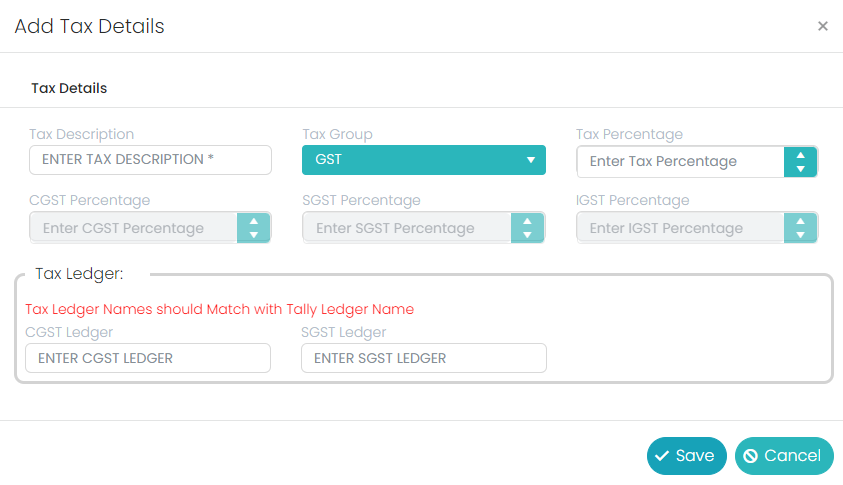

If we need to create tax percentage, which is related GST, first click on Add new record button to create new Tax, select GST from Tax Group field, fill the remaining details and click on Save button.

In the process of the GST tax group, we will find three more fields, i.e., CGST Percentage, SGST Percentage & IGST Percentage. Based on the entered Tax Percentage the CGST and SGST percentages will be equally divided and IGST will show the same which is there in the Tax percentage field.

Click on Edit button to edit the existing details of the tax master, change the details and click on Update button to save the changed details.

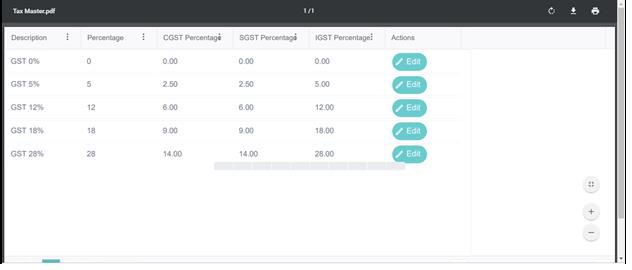

Below is the PDF format of tax details which we can get with the help of respective Export button.

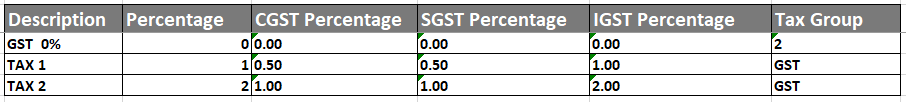

Below is the Excel format of tax details which we can get with the help of respective Export button.

TAX Group – TAX

Tax Description: Tax Description is a mandatory field in the Tax Master. Here enter the Name of the tax percentage.

Tax Group: Tax Group is a mandatory field in the Tax Master, here we will have two types of groups, i.e., ‘VAT’ and ‘GST’ select ‘VAT’ and proceed.

Tax Percentage: Tax percentage is a mandatory field in the Tax Master. Here enter the respective percentage and proceed.

CGST Ledger: CGST Ledger is not a mandatory field in the Tax Master, but optional. If we want to integrate Tally application with the prana application, then we must enter the ledger name of the CGST. Make sure that CGST ledger name should be same which is there in the Tally application for that tenant.

SGST Ledger: SGST Ledger is not a mandatory field in the Tax Master, but optional. If we want to integrate Tally application with the prana application, then we must enter the ledger name of the SGST. Make sure that SGST ledger name should be same which is there in the Tally application for that tenant.

TAX Group – GST