Vendor Master

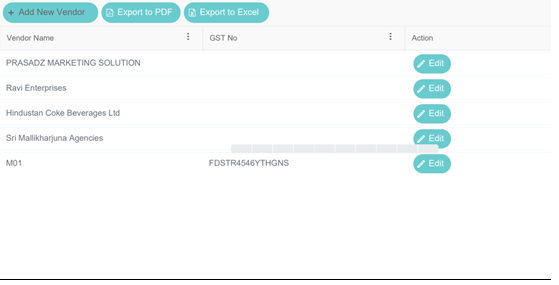

To create a new vendor or want to edit existing details of vendor, go to Masters, select Vendor Master.

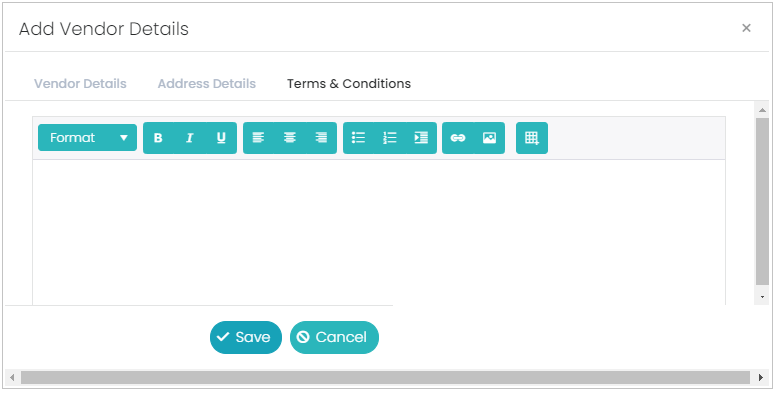

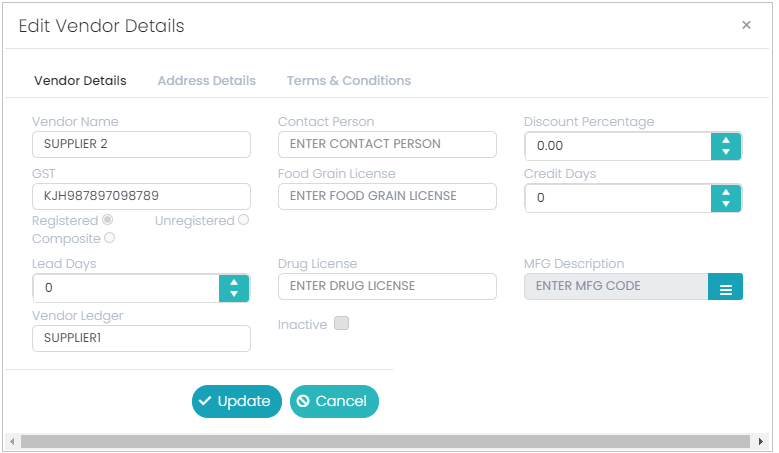

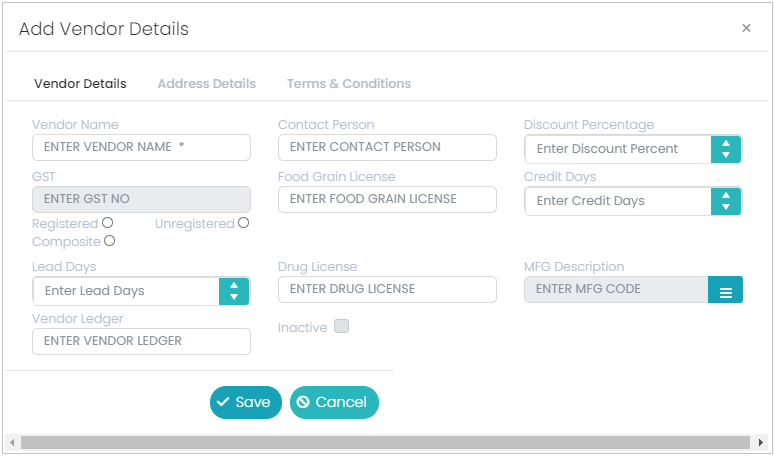

Enter the details in the three-tab pages (Vendor Details, Address Details and Contact Details) and click on Save button. Below is the Vendor Details tab.

In the Vendor Details tab page, there will be some of the fields, they are Vendor name, Contact Person, Discount Percentage, GST, Food Grain License, Credit Days,

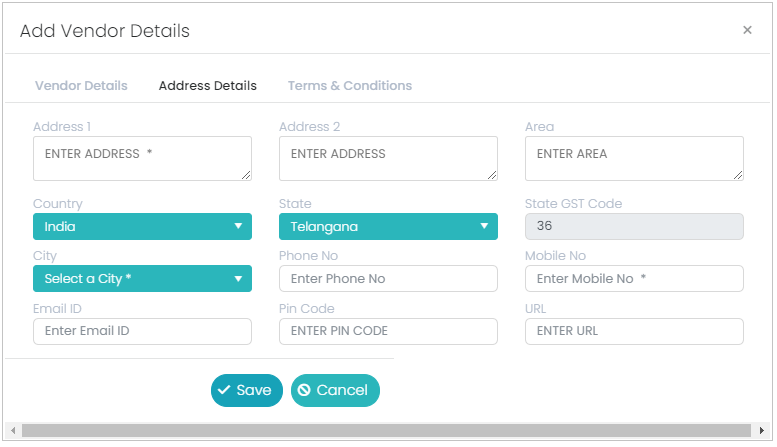

Address Details tab page, there will be some of the address fields, which includes address1, address2, area, country, state, state GST code, city, phone no, mobile no, email id, pin code & URL.

In the term and conditions tab we can enter the all terms and conditions which are related to the vendor. In the terms and conditions tab, we can have the multiple headings for the entered text, we can modify the text in the form of bold, italic, underscore, we can align the text, we can have the ordered list and unordered list in the terms and conditions, we can insert a hyper link here, we can include images here, and we can also include a table here.

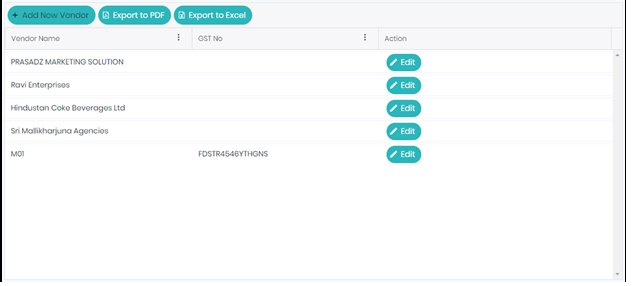

To edit the existing details select edit button of the respective record (Line item), change the details and click on Update button.

Below is the PDF format of vendor details which we can get with the help of respective Export button

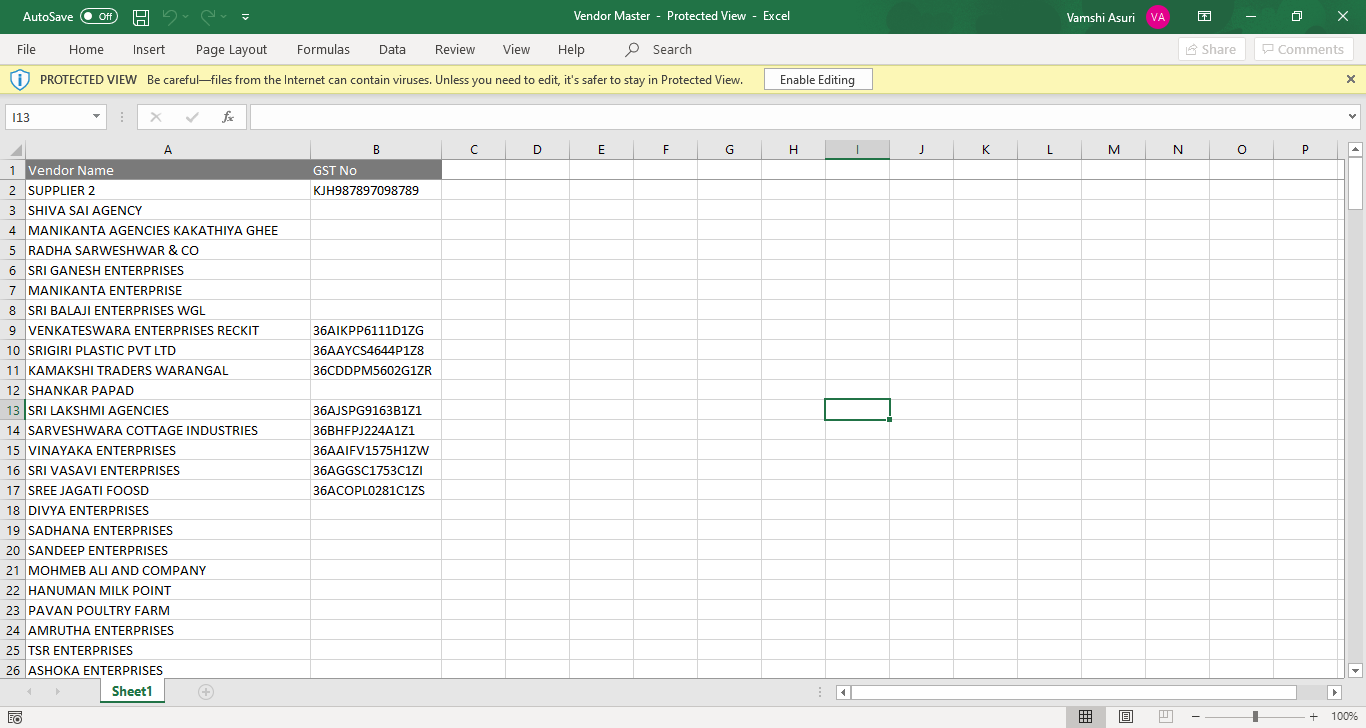

Below is the Excel format of vendor details which we can get with the help of respective Export button.

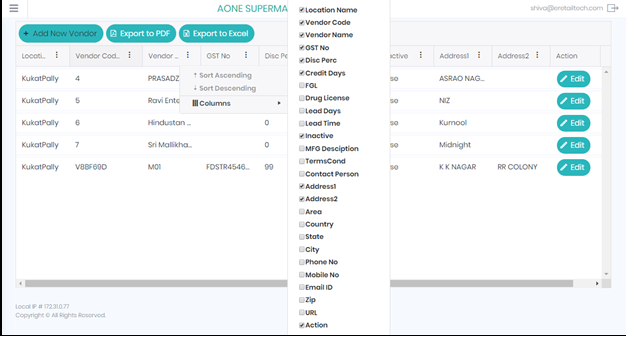

We can add or remove the columns of the Vendor Master depends upon the requirement. This will be applicable for all the masters as well. To enable or disable the columns of the form just we need to select the icon of three buttons, and it will show the list of all available columns, select/un select them as per the requirement.

Vendor Details Tab

Vendor Name: Vendor Name is a mandatory field in the Vendor Master. Enter the Name of the Vendor here and proceed.

Contact Person: Contact Person is not a mandatory field in the Vendor Master, but optional. Here enters the name of the contact person of the Vendor.

Discount Percentage: Discount Percentage is not a mandatory field in the Vendor Master, but optional. Enter here the discount percentage which the vendor is going to give to the buyer/Store.

If we define the discount percentage for the particular linking SKU’s to the Vendor will apply the discount automatically.

GST: GST is not a mandatory field in the Vendor Master, but optional. If we want to enter the GST number for the vendor, then the vendor must be GST Vendor. This field will be enabled only if we select the ‘Registered’ radio button in the ‘Vendor Details’ tab.

Food Grain License: Food Grain License is not a mandatory field in the Vendor Master, but optional. If the vendor is having Food Grain license, then enter the same here.

Credit Days: Credit Days is not a mandatory field in the Vendor Master, but optional. If the vendor is giving any credit days to the Store/Buyer, then enter those credit days here.

Registered: Registered radio button is not a mandatory in the Vendor Master, but optional. If the vendor is a registered vendor, select this option and later enter the GST number in its respective field.

Unregistered: Unregistered is not a mandatory in the Vendor Master, but optional. If the vendor is not a registered vendor, then we need to select this option.

Composite: Composite is not a mandatory in the Vendor Master, but optional. If the vendor is related to Composite tax payer, then we need to select this option.

Note: The composition scheme is meant for small businesses whose turnover of taxable goods not more than ₹1.5 Crores, where GST must be borne by the seller @ 1% of such turnover by Traders, @ 2% by Manufacturers, 5% for Restaurants & 6% for Service Providers

The Composition taxpayer cannot issue a tax invoice, because the tax must be paid by the dealer out of pocket. A Composition Dealer is not allowed to recover the GST from the customers. Service Providers Cannot opt for Composition Scheme but in Budget 2019, Government announced to have Service providers whose turnover is up to Rs. 50L can opt for Composition Scheme

The Composition Scheme is very helpful to small businesses. Compare to regular GST scheme, the Composition taxpayers are required to file a total of 5 GST Returns (i.e., Four Quarterly GSTRs in the form of CMP-08 & One annual GSTR in a year in the form of GSTR-4, GSTR-9A return was not yet declared). They cannot claim the Input Tax Credit on any purchases and are not required to maintain the books of accounts.

Lead Days: Lead Days is not a mandatory field in the Vendor Master, but optional. If vendor is giving any lead days to store/buyer, enter those lead days here. Lead days means, a purchase order lead time, i.e., the number of PG.26 days from when a company/buyer/store places an order for supplies, to when those items arrive or reach to company/buyer/store.

Drug License: Drug License is not a mandatory field in the Vendor Master, but optional. If the vendor is having any drug license, enter the same here.

MFG Description: MFG Description is not a mandatory field in the Vendor Master, but optional. If vendor connected to any manufacturer, then select the respective manufacturer from the list.

Vendor Ledger: Vendor Ledger is not a mandatory field in the Vendor Master, but optional. If we want to integrate Tally application with the prana application, then we must enter the ledger name of the Vendor here. Make sure that Vendor ledger name should be the same which is there in the Tally application for that tenant.

Inactive: Inactive is not a mandatory field in the Vendor Master, but optional. If we want to make vendor as inactive then we need to select this option.

Address Details Tab

Address1: Address1 is a mandatory field in the Vendor Master. Enter the address 1 part of the total address here.

Address2: Address2 is not a mandatory field in the Vendor Master, but optional. Enter the address 2 part of the total address here.

Area: Area is not a mandatory field in the Vendor Master, but optional. Enter the Area part of the total address here.

Country: Country is a mandatory field in the Vendor Master, select the required country from the list.

State: State is a mandatory field in the Vendor Master, based on the selected country the list of States will be shown in the list, select the required State here.

State GST Code: Based on the selected State, the State code will come here.

City: City is a mandatory field in the Vendor Master, based on the selected State, the City list will be shown, select the required City from the list.

Phone No: Phone number is not a mandatory field in the Vendor Master, but optional. Enter the phone number (land line number) of the vendor here.

Mobile No: Mobile number is a mandatory field in the Vendor Master, enter the mobile number of the vendor here.

Email ID: Email ID is not a mandatory field in the Vendor Master, but optional. Enter the Email ID of the vendor here.

PIN Code: PIN Code is not a mandatory field in the Vendor Master, but optional. Enter the PIN Code, of the area of the vendor here.

URL: URL is not a mandatory field in the Vendor Master, but optional. Enter the URL of the vendor if the vendor is having any.

Terms & Conditions Tab